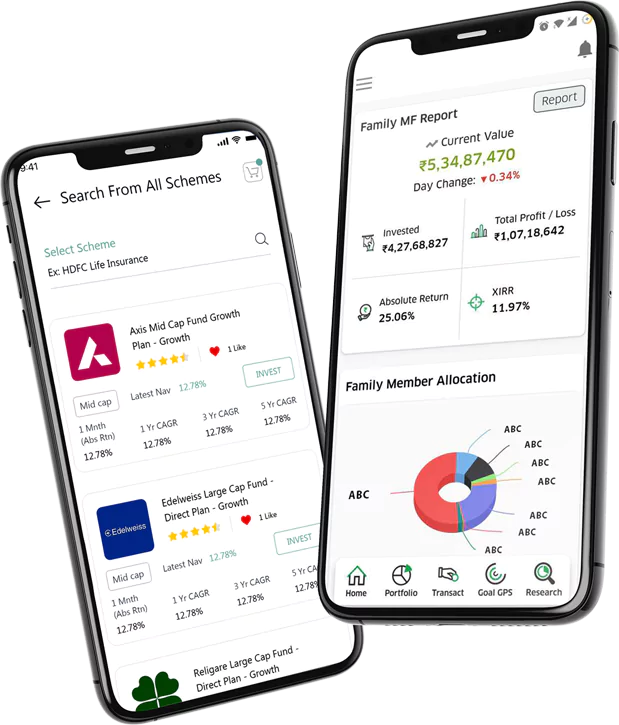

Start a SIP or purchase an ELSS in a few clicks completely online.

Become Financially-Free with Flying Colors

Achieve Your Dreams, Work for Your Passion, & Live Stress-Free

Get Free Consultation

No money, no worry

Finance your dreams easily with a car, home, or other loans.

Get Free Consultation

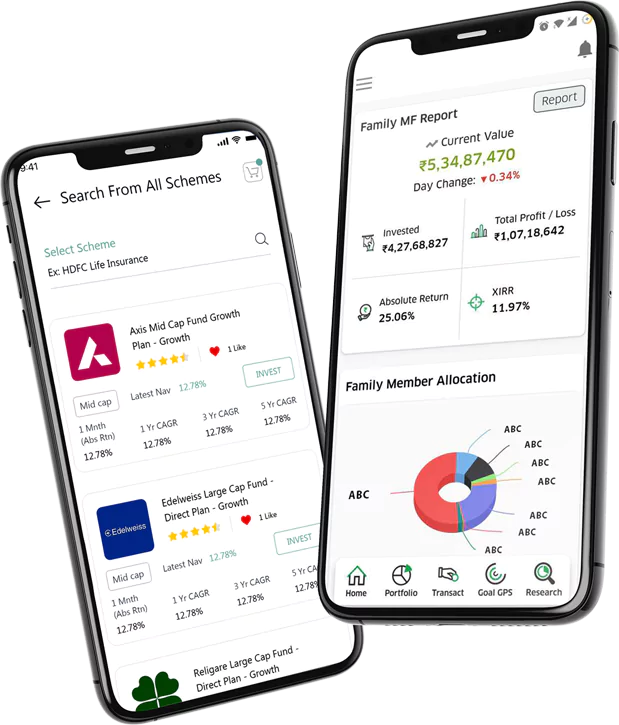

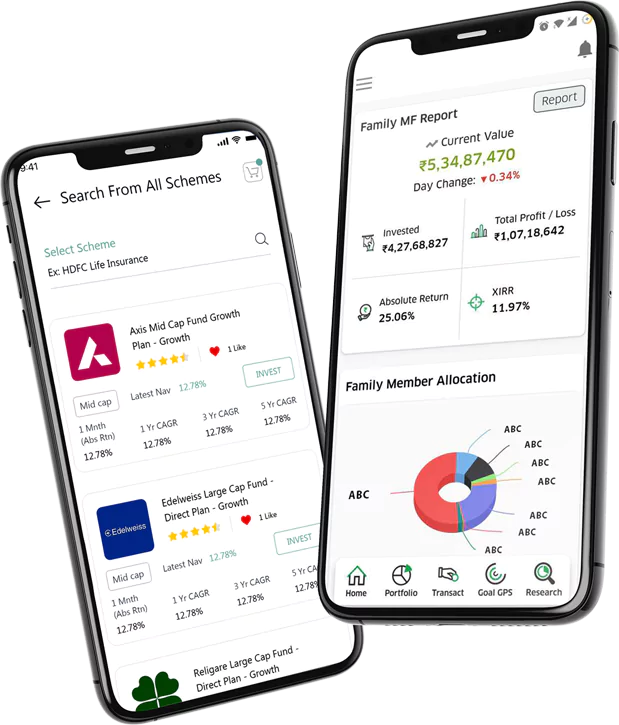

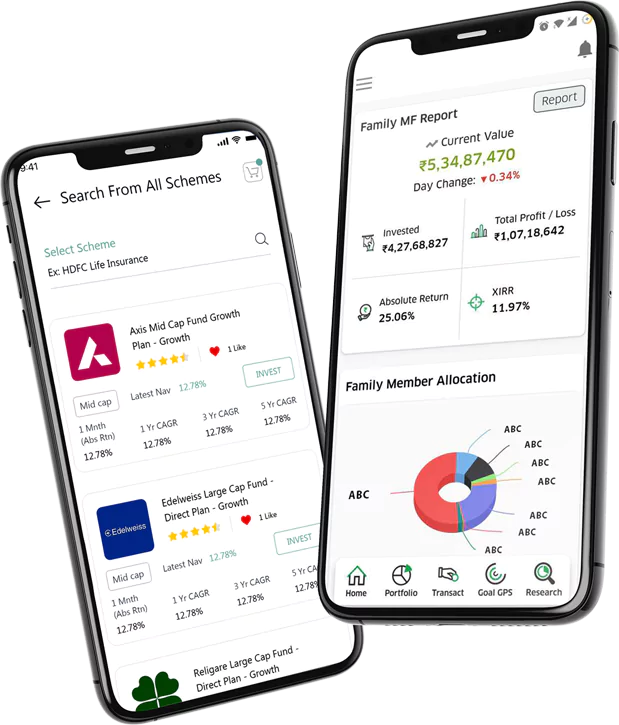

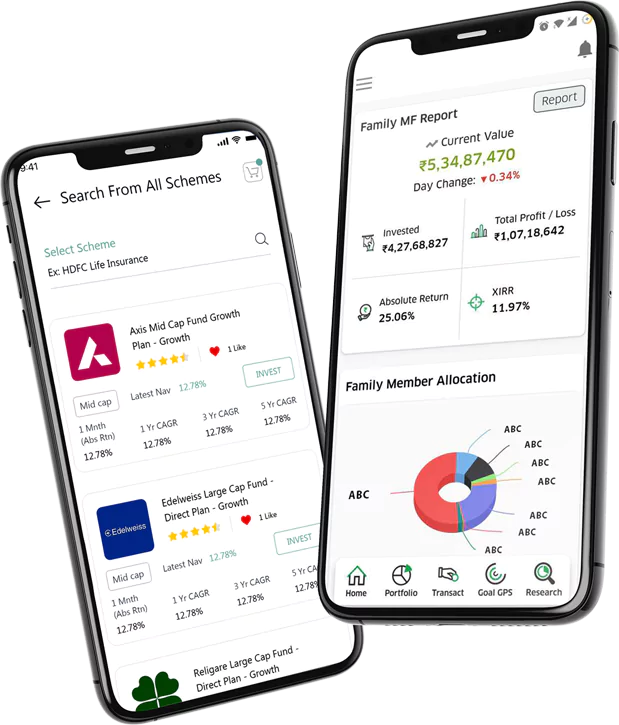

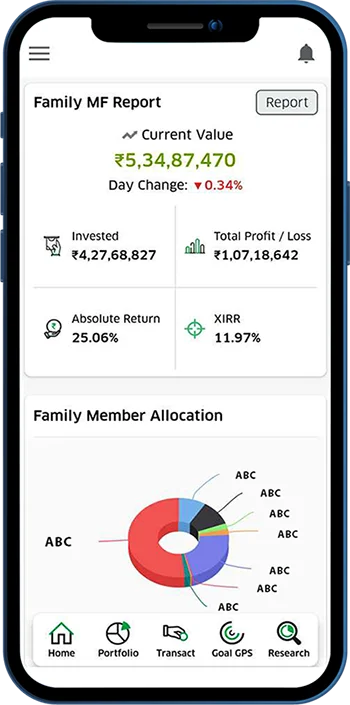

Put your money to work

Invest in mutual funds with SIP & achieve financial freedom.

Get Free Consultation

Plan your path to prosperity

Expert financial strategies for a prosperous tomorrow

Get Free Consultation

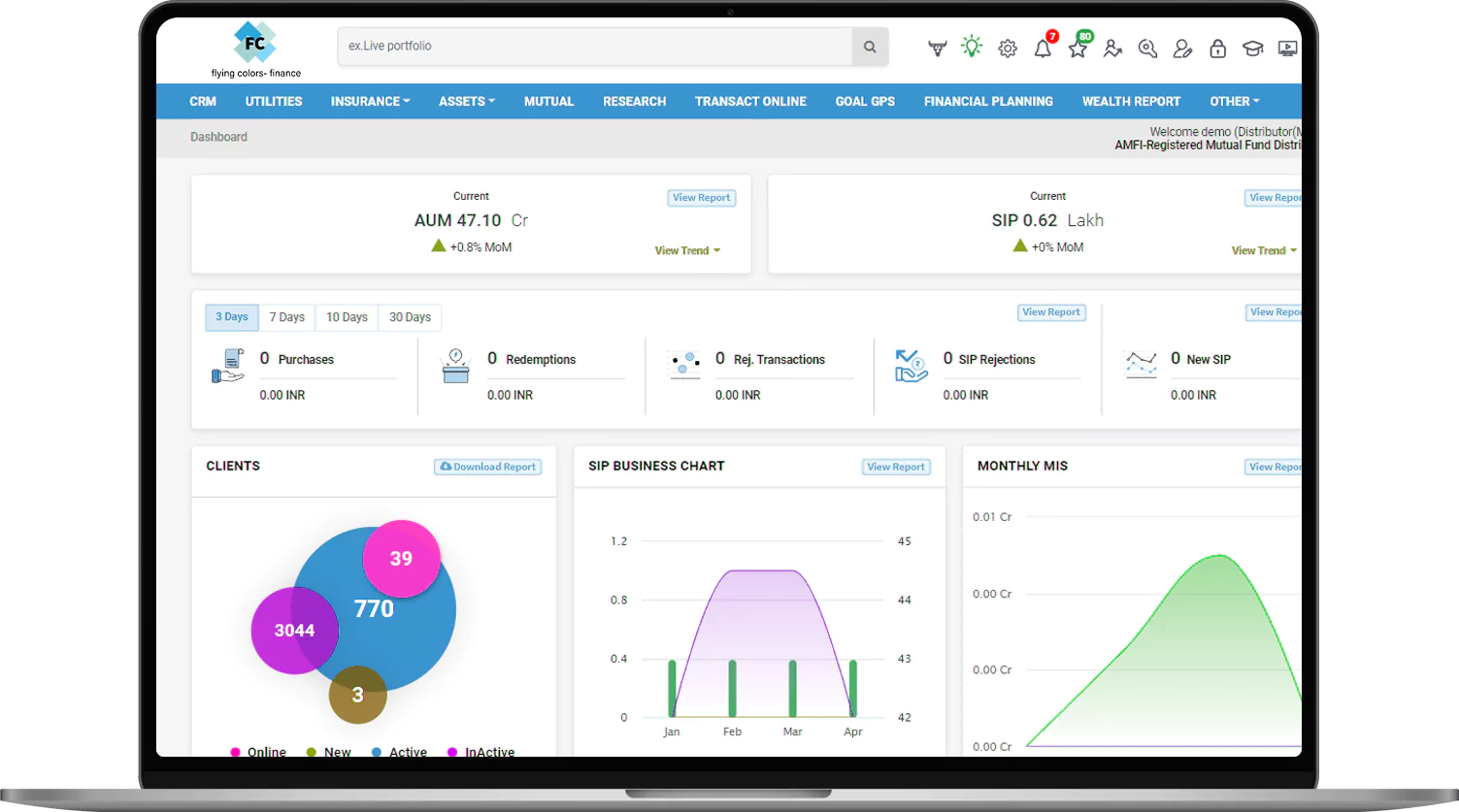

Optimize Investments, Maximize Returns

Be on the path to success with analysis & adjustments.

Get Free Consultation

.png)